The 3-Minute Rule for Pvm Accounting

The 3-Minute Rule for Pvm Accounting

Blog Article

8 Simple Techniques For Pvm Accounting

Table of ContentsThe Buzz on Pvm AccountingSome Ideas on Pvm Accounting You Should KnowWhat Does Pvm Accounting Do?Not known Factual Statements About Pvm Accounting The Ultimate Guide To Pvm AccountingThe smart Trick of Pvm Accounting That Nobody is Talking About

Manage and deal with the production and approval of all project-related payments to customers to cultivate great interaction and avoid problems. financial reports. Guarantee that ideal records and documentation are sent to and are upgraded with the internal revenue service. Guarantee that the audit process adheres to the regulation. Apply called for building audit requirements and treatments to the recording and reporting of building and construction task.Communicate with various funding agencies (i.e. Title Firm, Escrow Firm) pertaining to the pay application procedure and demands needed for repayment. Assist with executing and maintaining internal economic controls and treatments.

The above declarations are meant to describe the basic nature and degree of work being carried out by people assigned to this category. They are not to be taken as an extensive list of obligations, responsibilities, and skills called for. Employees may be required to execute obligations beyond their typical obligations every so often, as needed.

Pvm Accounting Fundamentals Explained

You will certainly help sustain the Accel team to guarantee distribution of successful on time, on spending plan, jobs. Accel is looking for a Construction Accounting professional for the Chicago Office. The Building Accounting professional carries out a selection of accountancy, insurance conformity, and task administration. Works both individually and within specific departments to keep economic records and make sure that all documents are maintained present.

Principal responsibilities consist of, yet are not restricted to, handling all accounting features of the firm in a timely and accurate manner and offering reports and routines to the business's certified public accountant Firm in the prep work of all monetary declarations. Ensures that all bookkeeping procedures and functions are handled precisely. Accountable for all monetary documents, pay-roll, financial and everyday procedure of the audit feature.

Works with Task Supervisors to prepare and post all monthly billings. Produces regular monthly Job Price to Date records and functioning with PMs to fix up with Project Supervisors' budget plans for each job.

Pvm Accounting - Questions

Effectiveness in Sage 300 Building and Property (formerly Sage Timberline Workplace) and Procore construction administration software program a plus. https://fliphtml5.com/homepage/dhemu/leonelcenteno/. Need to likewise be competent in various other computer software application systems for the preparation of reports, spreadsheets and other accounting evaluation that might be needed by monitoring. construction taxes. Must possess solid organizational abilities and ability to prioritize

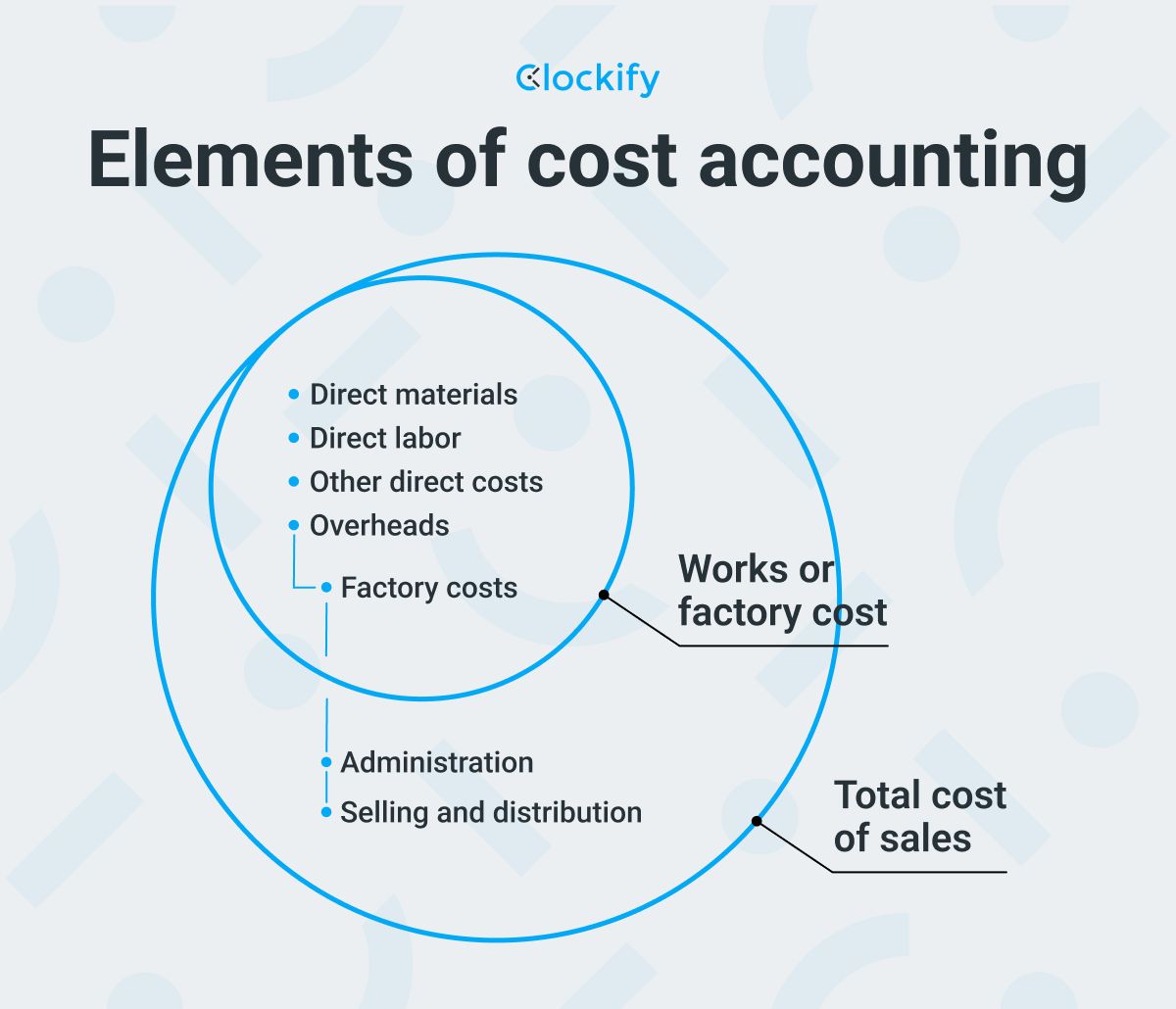

They are the monetary custodians that ensure that building tasks continue to be on budget, follow tax obligation laws, and maintain monetary transparency. Building accounting professionals are not simply number crunchers; they are strategic partners in the building procedure. Their main duty is to manage the financial elements of building and construction tasks, ensuring that resources are alloted effectively and economic threats are minimized.

The Buzz on Pvm Accounting

They work closely with project managers to create and keep track of spending plans, track expenses, and projection monetary demands. By maintaining a tight hold on project financial resources, accounting professionals aid protect against overspending and economic troubles. Budgeting is a cornerstone of successful building tasks, and building and construction accounting professionals are instrumental in this regard. They produce thorough spending plans that incorporate all task expenditures, from products and labor to licenses and insurance.

Construction accounting professionals are well-versed in these guidelines and ensure that the job complies with all tax needs. To excel in the role of a building accounting professional, individuals need a solid academic foundation in accountancy and finance.

Furthermore, accreditations such as Licensed Public Accountant (CERTIFIED PUBLIC ACCOUNTANT) or Qualified Building Sector Financial Specialist (CCIFP) are highly related to in the market. Building projects often entail tight deadlines, transforming guidelines, and unexpected expenditures.

The Definitive Guide to Pvm Accounting

Ans: Building and construction accounting professionals create and check budget plans, identifying cost-saving possibilities and making sure that the project stays within budget. Ans: Yes, recommended you read building and construction accounting professionals manage tax conformity for building tasks.

Introduction to Building And Construction Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction business need to make tough selections among several financial choices, like bidding on one job over another, choosing funding for materials or devices, or establishing a project's revenue margin. In addition to that, construction is an infamously volatile market with a high failure rate, slow-moving time to settlement, and inconsistent money circulation.

Manufacturing includes repeated procedures with easily identifiable prices. Production needs various processes, products, and tools with varying prices. Each job takes area in a new place with varying website conditions and special obstacles.

Everything about Pvm Accounting

Resilient relationships with suppliers relieve arrangements and enhance efficiency. Irregular. Frequent use of various specialty contractors and vendors affects effectiveness and cash money circulation. No retainage. Repayment gets here in full or with routine settlements for the complete contract quantity. Retainage. Some section of repayment might be kept till job conclusion even when the specialist's job is finished.

While traditional makers have the advantage of regulated environments and enhanced manufacturing processes, construction business must regularly adapt to each new task. Even rather repeatable projects need modifications due to website problems and other variables.

Report this page